How to Stop Spending Money

A series exploring the decisions, changes, and principles we stuck to that made moving to Sicily possible.

Because, Your Health, You Know

In last month’s edition of This is a Mistake, I shared how quitting my job 15 years ago reshaped our lives significantly, from writing, to raising a family, to altering our work mentality to serve our needs instead of us serving the needs of others, corporations, public institutions, and such. It was a 100% about face for us as we were both at the time looking forward to solving the challenge of being a one-income family. Franca’s return to teaching was going to bring about big changes for us in terms of spending we’d never before seen.

Only, it didn’t, and it didn’t because we didn’t let it.

In the essay I listed 10 things we did to help us—some mentally, some physically—to facilitate our change of heart. In case you missed it, you can find the essay here, but to refresh your memory, here’s the list:

Things We Did to Get Here

Most can be boiled down into two categories:

- Stop spending money, period. But especially on things that don’t bring you joy.

- Stop spending time on anyone or anything that doesn’t make you feel good

The rest, in no particular order

- Don’t run with the herd

- Learn how to take care of your things and yourself

- Find happiness in being content

- Do work you love for someone you love

- Invest in the list

- Ask for help where and when you need it

- Accept gifts

- When you stumble, and you will, get back up again

As promised, I’d like to take each one of those 10 items and explore them better over the coming months, starting with the first on the list:

Stop spending money

We get asked one question a lot—especially by young people hoping, perhaps, to not stumble into the same trap many of their parents did, people around our same age who are asking themselves where the hell did they go so wrong. Trapped in a dead end job. Trapped working for someone uninspiring. Trapped in an industry they can’t stand. Trapped trying to keep up with everyone else and trapped believing they are less of a person if they aren’t able. Or worse, choose not to. All this for a paycheck that fails to deliver joy, purpose, or at least some degree of contentment.

The answer we offer is not to just change jobs or careers or make more money, and not even follow their passion, but to first change the way they think about money.

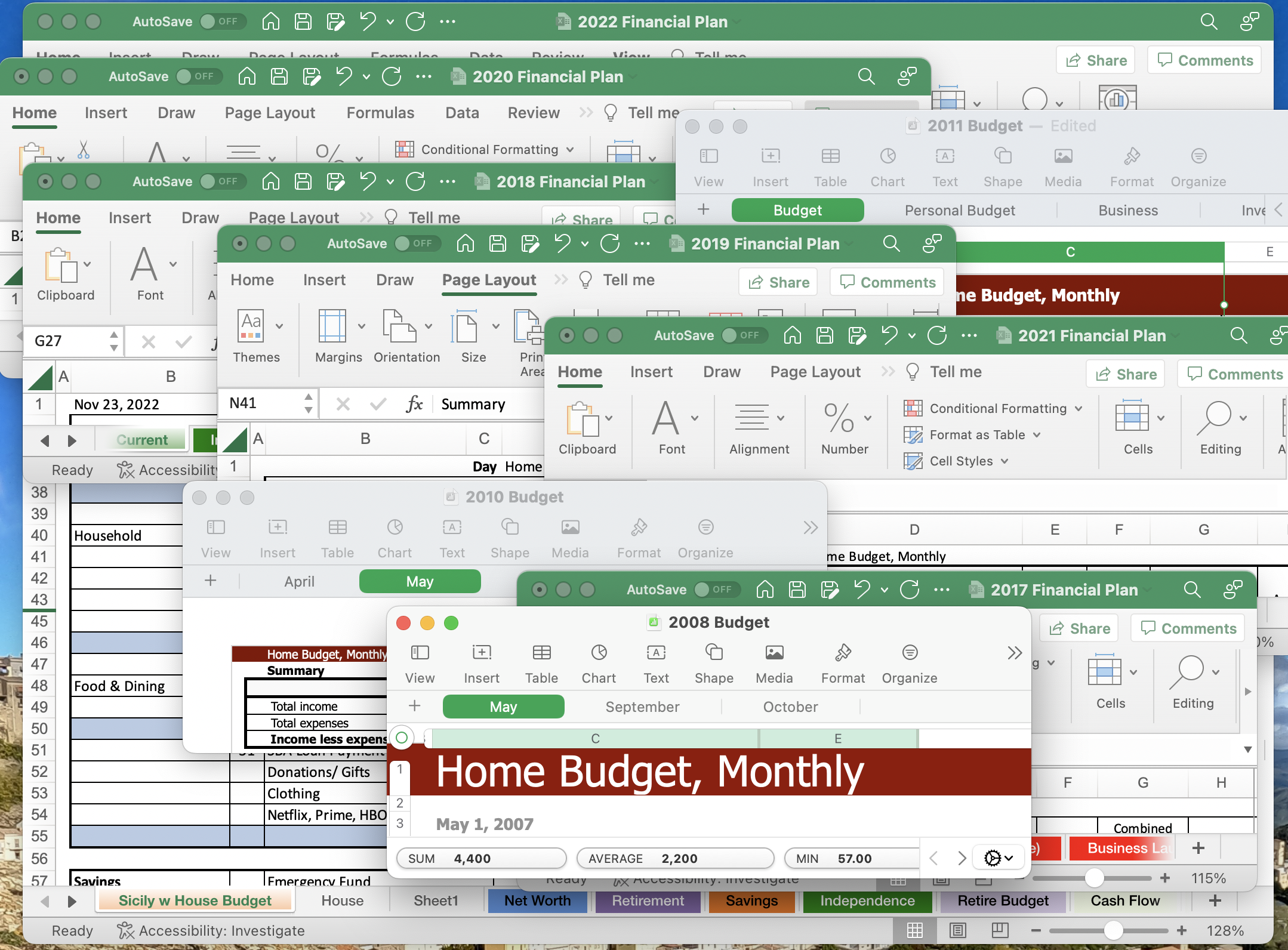

When I planned to quit my job (really, it was we quitting my job), the first thing we did was sit down and create a monthly budget. Our initial intent was to plan to set aside as much as we could of our second income to offset the loss of the other. And for eighteen months we did just that. Cutting costs. Not buying new stuff just to replace old stuff. Saving as much as we could.

Prior to this our spending was pretty reactive, that is, at the end of the month, we’d ask ourselves where the hell did all the money go, as opposed to looking ahead at the start of the month and choosing where to spend it.

That’s a big difference, both fiscally and mentally speaking. Once you’ve adopted that mindset, what follows is easy math:

$ Planned Income - $ Planned Expense = Living within (or below) your means

Income either covers the cost of living or does not. Surplus is good, deficit is bad (bad in the sense, it can’t last. Sorry, the government may be able to run on a deficit spending—and often does, for a shed-load of good reasons—but alas, for the rest of us, who lack a printing press, eventually the bank comes a-calling). The important part, to start anyway, is having a plan.

We made one and what happened next surprised us.